The Mortgage Corner

It’s not only the S&P Case-Shiller Home Price Index that is finally rising after falling drastically since June 2010, end of the home buyer tax credit. Both new and existing-home median prices are also rising. For Case-Shiller, 16 of the 20 metro areas were up in May.

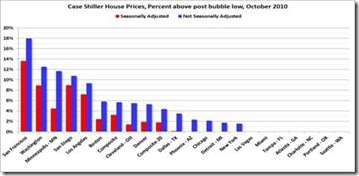

San Francisco, Washington, Minneapolis, San Diego, and Los Angeles have risen the most from their post-bubble lows. The data through May 2011 actually showed a second consecutive month of increase for the 10- and 20-City Composite Indexes, non-seasonally adjusted, up 1.1 and 1.0 percent, respectively, over April. Sixteen of the 20 Metro Statistical Areas rose, as we said, with San Francisco up a huge 18 percent since the lows; Detroit, Las Vegas and Tampa were down over the month and Phoenix was unchanged.

New home sales fell 1.0 percent in June to an annual rate of 312,000 vs expectations for 321,000, but the median price was up 5.8 percent to $235,200 and the average price up 1.8 percent to $269,000.. Upward revisions of 13,000 to May and April sales helped, said Econoday. Year-on-year prices also jump into the positive ground in June, up plus 7.2 percent for the median price and up 4.8 percent for the average.

Sales of existing homes failed to pick up in June, slipping 0.8 percent to an annual adjusted rate of 4.770 million and following May’s 3.8 percent decline. But the median price jumped a monthly 8.9 percent to $184,300 with the year-on-year rate moving into positive ground for the first time this year at plus 0.8 percent.

And the FHFA (Federal Housing Finance Agency) purchase only house price index for homes with conforming loans rose 0.4 percent in May, following a 0.2 percent increase in April. On a year-on-year basis, the FHFA HPI is down 6.3 percent. For the nine Census Divisions, seasonally adjusted monthly price changes for month-ago May ranged from minus 1.0 percent in the West South Central Division to plus 2.0 percent in the Mountain Division. Six of the nine Census Divisions improved in May.

What is happening? It looks like more affluent buyers are beginning to buy homes. Let us hope this trend continues, since it means workers may be finding better paying jobs.

Harlan Green © 2011

No comments:

Post a Comment