The Great Recession is officially over. We really can breathe a sigh of relief—even though job formation is just now picking up, while major segments are still stagnating; such as real estate, and motor vehicle production. But stocks continue to rally, manufacturing is recovering, and exports are soaring.

The National Bureau of Economic Research (NBER), a non-profit panel of leading economic professors, said it actually ended in June of 2009, which is where this columnist saw it ending, as that was when overall output began to pick up. But that is small comfort to those still out of work.

The announcement is still good news, as it may cancel out the pessimists who say we are still in a recession, or those who say we must begin to cut the deficit when the private sector isn’t yet creating enough jobs. And that will make a difference to consumers, most of who know little about economic signs, and so have to rely on their basic optimism or pessimism about future prospects in making their financial decisions.

The NBER said its determination of the recession's end does not mean the U.S. is now healthy.

"In determining that a trough occurred in June 2009, the committee did not conclude that economic conditions since that month have been favorable or that the economy has returned to operating at normal capacity, NBER said. "Rather, the committee determined only that the recession ended and a recovery began in that month."

It was an 18-month recession, the longest in fact since the 1929-33 first Great Depression, which lasted 43 months. This is why the economy is taking so long to recover. In other words, it began to contract in December 2007, the official beginning of the recession, and the contraction ended in June 2009.

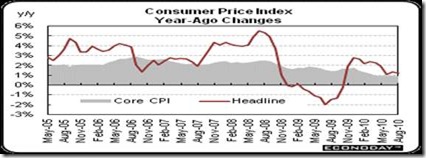

That is probably the reason the press release of the Fed’s Open Market Committee (FOMC) latest meeting hinted at more credit easing in the fall, as it sees a danger of actual deflation, rather than lower inflation. Deflation is the danger most feared by economists at present, since lower prices also mean stagnant economic growth as well.

"Measures of underlying inflation are currently at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability", said the release.

The "somewhat below" language is in contrast to “measures of inflation have trended lower" in the previous statement, said Econoday. With inflation below the Fed's implicit inflation target, the Fed appears to be stating that inflation is too low, which was the case in 2002, when the Fed was faced with the same dilemma. So the Fed is saying that the deflation risk is higher than the re-inflation risk and the door is now open to additional quantitative easing.

Why is some inflation important? It would mean there is sufficient demand for products and services to warrant expanding production, which means consumers are willing to increase their spending, in a word. Decades-long deflation is why the Japanese economy is no longer the Asian Tiger, with China taking its place as the world’s second-largest economy behind the U.S.—at least on paper.

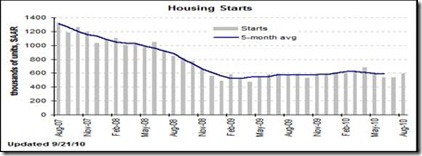

There was some good news on the housing front, which could signal that the housing bubble is finally bottoming out. Housing starts in August jumped 10.5 percent after rising a modest 0.4 percent in July. The August annualized pace of 598,000 units clearly topped analysts' expectations for 550,000 units and is actually up 2.2 percent on a year-ago basis. The gain in August was led by a 32.2 percent surge in multifamily starts, following a 36.0 percent increase in July. The single-family component rebounded 4.3 percent after dipping 6.7 percent in July.

The August Consumer Price Index reading confirms why the Fed is concerned about deflation. Year-on-year, overall CPI inflation slipped to 1.2 percent (seasonally adjusted) from 1.3 percent in July. The core rate in August was steady at 1.0 percent. These numbers are well below the bottom of the Fed’s implicit target range for inflation of 1-1/2 to 2 percent for the PCE price index, which this writer believes should be raised to 2-1/2 to 3 percent to encourage higher salaries—which are two-thirds of product costs, as we have said.

So will the latest news lift consumers’ spirits? Firstly, prices have to stop falling, so that employers will be encouraged to hire. That is why further stimulus measure are so important. We cannot afford to repeat Japan’s experience, and so lose our place as the world economic leader.

Harlan Green © 2010

No comments:

Post a Comment